In this article,we will learn about every basic terms of Intraday Trading like:-SL,PE,CE,Market Order,Limit,GTT,Strike Price,ATM,OTM,ITM etc. in simple words.But first we will discuss about Intraday Trading.

What is Intraday Trading?

Intraday trading is a type of stock market trading where you buy and sell stocks within the same trading day. Instead of holding onto stocks for the long term, intraday traders aim to make profits by capitalizing on short-term price movements.

Read:-Types of Trading in Stock Market.

By engaging in intraday trading, you acknowledge and accept these risks and agree to conduct your trading activities in a prudent and responsible manner. It is recommended to thoroughly educate yourself about intraday trading strategies, risk management techniques, and market dynamics before participating in intraday trading.

Basic Terms of Intraday Trading

Here are some basic terms commonly used in intraday trading:

- Leverage:Leverage is using borrowed funds to increase the potential return of an investment. In intraday trading, leverage allows traders to control a larger position with a smaller amount of capital.

- Margin: The amount of money or securities required to cover the potential losses of an investment. In intraday trading, margin is often used to leverage positions.

- Stop-Loss Order(SL): An order placed by a trader to automatically sell a security once it reaches a certain price, limiting potential losses.Stop-Loss is probably most important term in the stock market to reduce the risk of losing trade.

- Take-Profit Order: An order placed by a trader to automatically sell a security once it reaches a certain price, locking in profits.

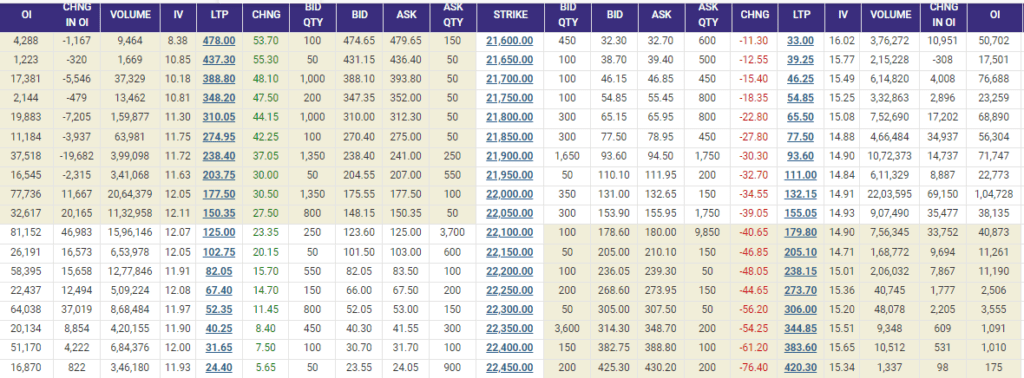

- Bid Price: The highest price a buyer is willing to pay for a security at a given time.If you are trading in Index then you can see Bid and Ask Price on Option chain.

- Ask Price: The lowest price a seller is willing to accept for a security at a given time.

- Spread: The difference between the bid price and the ask price of a security. A narrower spread indicates higher liquidity.

- Volatility: The degree of variation of a trading price series over time. Intraday traders often seek assets with high volatility to capitalize on price fluctuations.

- Volume: The number of shares or contracts traded in a security or market during a given period. High trading volume indicates strong interest in a security.

- Portfolio: A portfolio is a collection of investments owned by an individual or entity. Just like a collection of photographs in a physical portfolio folder, a financial portfolio contains various assets such as stocks, bonds, mutual funds, real estate, or other investment vehicles. The purpose of a portfolio is to manage and grow wealth over time by diversifying investments and balancing risk and return. It’s like putting together a mix of different items to achieve your financial goals, whether it’s saving for retirement, funding education, or building wealth.

- Watchlist: A watchlist is a tool used by investors to keep track of potential investment opportunities. It’s like a personalized list of stocks or other securities that you’re interested in monitoring. Rather than buying immediately, you “watch” these investments to see how their prices and performance change over time. Watchlists help investors stay informed about market trends, track the progress of specific companies, and identify opportunities for buying or selling based on their investment criteria.

Here are some Terms especially used in Option Trading:

- Strike Price: The strike price, also known as the exercise price, is a term commonly used in options trading. It refers to the predetermined price at which the holder of an option contract can buy or sell the underlying asset.

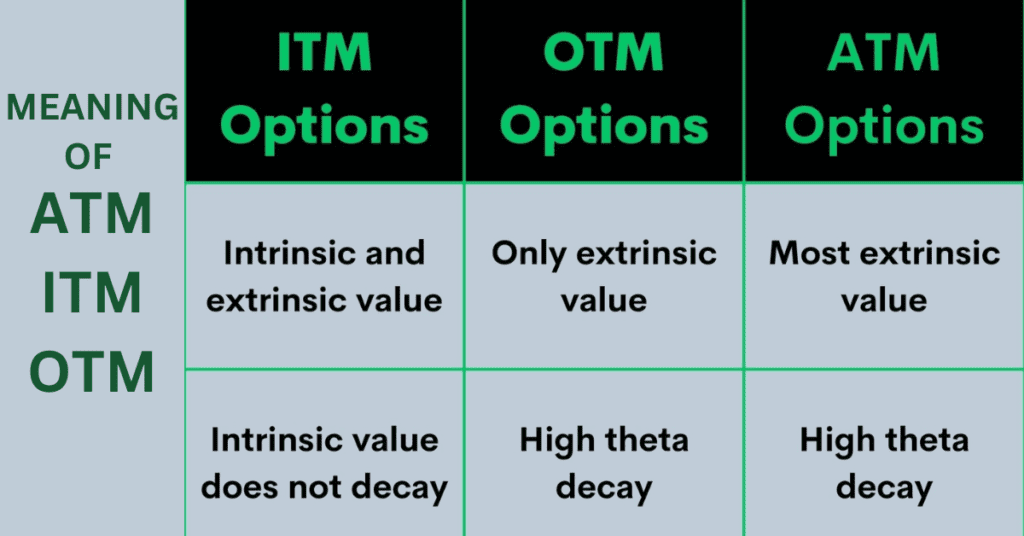

- (At-The-Money)ATM: An option is considered at-the-money when the strike price of the option is approximately equal to the current market price of the underlying asset. In other words, the option has neither intrinsic value nor time value. For example, if a stock is trading at $50 per share, a call option with a strike price of $50 and a put option with a strike price of $50 would both be considered at-the-money.

- (Out-of-The-Money)OTM:An option is considered out-of-the-money when the strike price of the option is higher (for call options) or lower (for put options) than the current market price of the underlying asset. In this situation, the option does not have intrinsic value but may still have some time value. For example, if a stock is trading at $50 per share, a call option with a strike price of $55 or higher, or a put option with a strike price of $45 or lower, would be considered out-of-the-money.

- (In-The-Money)ITM: An option is considered in-the-money when the strike price of the option is lower (for call options) or higher (for put options) than the current market price of the underlying asset. In this scenario, the option has intrinsic value because it can be immediately exercised for a profit. Additionally, it may also have some time value. For example, if a stock is trading at $50 per share, a call option with a strike price of $45 or lower, or a put option with a strike price of $55 or higher, would be considered in-the-money.

- GTT(Good Till Time):A “Good ‘Til Time” order is a type of order you can place with your broker to execute a trade at a specified price, but only during a specific time frame. Once you place a GTT order, it remains active until the designated time expires, or until the order is executed or canceled, whichever comes first.For example, if you place a GTT order to buy a stock at $50, and you set the time for the order to remain active until the end of the trading day, the order will stay open until the end of the trading day unless it gets filled or canceled before that time.GTT orders can be useful if you want to enter or exit a position at a specific price but are unable to monitor the market continuously. They provide flexibility by allowing you to set a timeframe within which the order should be executed.

- (Put)PE: The Term PE Stand for Put Option and it helps traders and investors quickly identify whether they are looking at put options or call options at that particular strike price. This distinction is crucial because put and call options have different risk-reward profiles and are used for different trading strategies.

- (Call)CE:Similarly,CE Stands for Call Option and By specifying “PE” or “CE” along with the strike price, it helps traders and investors quickly identify whether they are looking at put options or call options at that particular strike price. This distinction is crucial because put and call options have different risk-reward profiles and are used for different trading strategies.

- Market Order:A market order is an instruction given by an investor to a broker to buy or sell a security (such as stocks, bonds, or ETFs) at the best available price in the current market. When you place a market order, you are essentially telling your broker to execute the trade immediately at the prevailing market price, regardless of the specific price level.

- Limit: A limit order is an instruction given by an investor to a broker to buy or sell a security (such as stocks, bonds, or ETFs) at a specified price or better. Unlike market orders, which prioritize speed of execution over price, limit orders allow investors to control the price at which their trade is executed.

- LTP: “LTP” stands for “Last Traded Price.” In financial markets, especially in the context of trading stocks, commodities, or other securities, the LTP refers to the price at which the most recent transaction for a particular security occurred.

- Lot: In the context of the Nifty index in India, a “lot” typically refers to a standardized contract size for trading Nifty index options. Specifically, in the National Stock Exchange of India (NSE), one lot of Nifty options typically represents a contract size of 50 units.