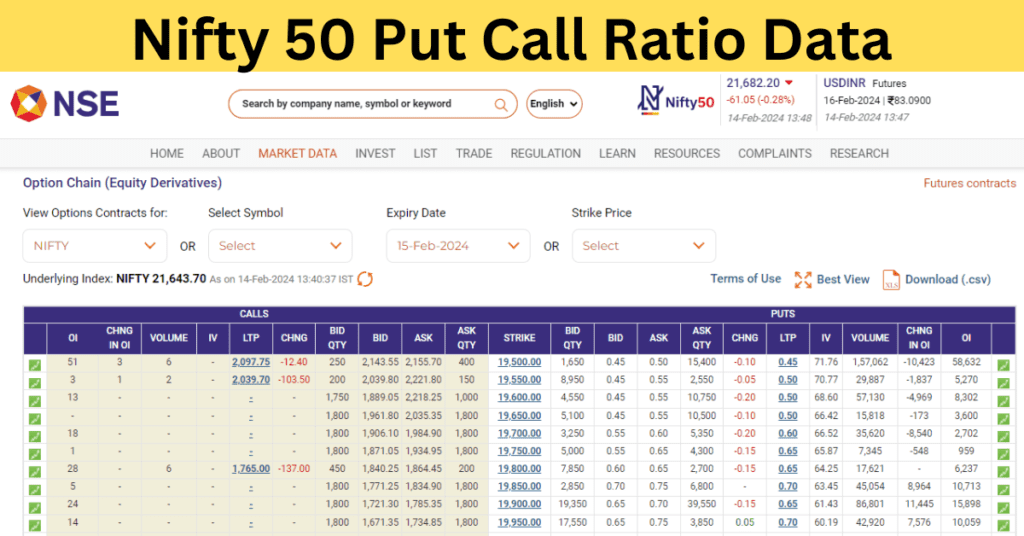

Nifty 50 Put Call Ratio(PCR) is a financial metric used to determine investor mood in the options market.We will discuss about PCR in detail and also learn to calculate PCR in this article.

Understanding Put/call Ratio:

Put/Call Ratio (PCR) indicator was created especially to assist traders in determining the general sentiment (mood) of the market in day trading.It is the Put to call ratio of either open interest for specific period of time or volume traded in option trading, that is why it is called Put-Call Ratio in stock market.

Open Interest: Open interest refers to the total number of outstanding or unclosed options or futures contracts in a market. In simple terms, it represents the number of contracts or financial agreement that have been initiated and are still active, rather than being closed out through an offsetting trade(a transaction that effectively cancels out or neutralizes the impact of an existing position).

Volume: volume refers to the total number of shares (or contracts in the case of options and futures) traded during a specific period, typically within a trading day.

How PCR is Calculated:

The put-call ratio is calculated by dividing the total number of outstanding put options by the total number of outstanding call options. This ratio is used as an indicator of investor sentiment towards the market or a particular security.

Learn:-What is Leverage in Stock Market?

Here’s how you calculate it:

♦Based on Open interest of Specific Period of Time:

The Put Call Ratio (PCR) based on open interest tells us if more people are buying options to sell stocks (puts) or to buy stocks (calls). It helps traders understand market sentiment. If there are lots of puts, it might mean people are worried about the market going down. If there are lots of calls, it might mean people expect the market to go up. Traders use this info to make decisions about buying or selling stocks.

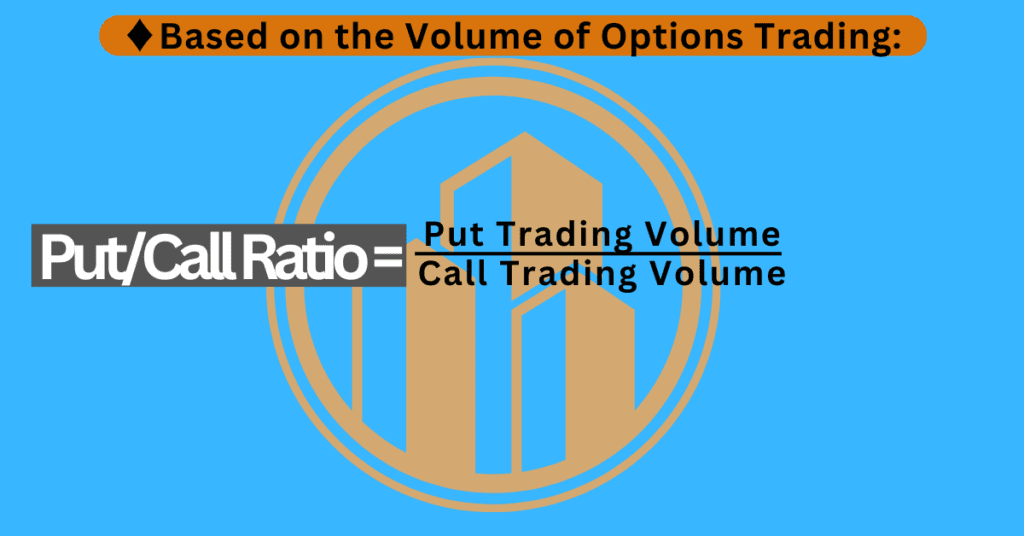

♦Based on the Volume of Options Trading:

Similarly,The PCR (Put Call Ratio ) based on options trading volume shows the balance between the number of puts and calls being traded. It indicates whether more people are buying options to sell stocks (puts) or buying options to buy stocks (calls). If there’s a high PCR, it suggests that more puts are being traded, which might mean investors are feeling cautious or bearish about the market. Conversely, a low PCR suggests more calls are being traded, indicating bullish sentiment or optimism among investors. Traders use this information to assess market sentiment and potential trends in stock prices before making trading decisions.