FII and DII plays a significant role in financial market as they contribute to capital flows between countries.When FII and DII invests in particyular stock market, they can impact assets price and market condition.Goverment and regulatory bodies often closely monitor FII and DII activities,as their investement can influence the overall stability and performence of country’s finencial markets.

What is FII and DII?

FII:-

FII stands for Foreign Institutional Investor,referring to institutional investors from outside the country where they invest such as mutual finds, pension funds, insurance companies and other investenment entities.They play a crucial role in providing liquidity to the market and can influence market dynamics.

The benefits of FIIs include increased market efficiency, improved liquidity and access to foreign capital.However, they can also pose risk, such as volatility in financial market and potential capital flight during economc downturns.

Countries typically have specific regulations goiverning FII participation, including limits on ownership percentages, reprting requirements, and eligibility criteria.Monitoring and adapting these regulations help ensure that FII activitieds align with the broder economic goals of the host country.

Types of FII in India:

- Sovereign Wealth Funds – A SWF is a type of investment fund that is administered by the state and it is funded by the government, generally through the sale of surplus reserves. The development of SWFs benefits both a nation’s economy and its inhabitants.

- Foreign Government Agencies -Foreign government agencies refer to governmental entities or organizations that operate outside their home country’s borders for various purposes. These agencies typically engage in diplomatic, economic, or developmental activities with the goal of representing the interests of their home government abroad.

- International Multilateral Organisations – Multilateral organizations are formed when three or more countries join forces to work on issues that are relevant to each of them. They ensure that everyone has a say in the management of world issues, as well as that any relief efforts are legal.

- Foreign Central Banks – A foreign central bank is a bank that is the primary authority other than the government that provides instruments meant to be used as money under the authority of law or government approval. A central bank is a financial institution that serves as the repository for a country’s currency reserves.

Regulations on FIIs on investing in Indian companies:

In India, the regulatory body responsible for overseeing and regulating FII is the Securities and Exchange Board of India(SEBI). FII are allowed to invest in Indian primary and secondary capital markets only through the countries portfolio investement scheme.

However, there are many limitations on FII in India.ie:-FIIs are generally limited to a maximum investement of 24% of the paid up capital of the Indian company receiving the investement.However,FIIs can invest upto 30% if the investement is approved by the company’s board and a special resolution is poassed.

Example of FIIs in India:

Companies in India that have many FIIs stake are:-CarTrade Tech,Axis Bank, PB Fintech, ITC, ICICI Bank, HDFC Bajaj finserve ltd. and many more.

DII:-

DII stands for Domestic institutional Invwestors.These are Institutions based within the country where the stock exchange is located, such as mutual funds, insurance companies and pension funds. DII participation in the stock market can influence market movements and is a key factor in understanding overall market dyanmics.DII play a significant role in shaping market trends through their buying and selling activities,impacting stock prices and market liquidity.

Types of DII in India:

- Mutual Funds:-A mutual fund pools money from multiple investors and invests it in a diversified portfolio of stocks, bonds, or other securities according to a specific investment objective.

- Insurance Companies:-Insurance companies invest their funds in various financial instruments to generate returns and meet their policy obligation.

- Pension Funds:-Pension funds are investement pools managed to provide retirement income for members.They typically invest in diverse assets,aiming to grow funds over time to meet future pension obligations.

- Exchange-Traded Funds(ETFs):-An Exchange-Traded Fund (ETF) is a type of investment fund and exchange-traded product, with shares that are tradeable on a stock exchange. ETFs are designed to track the performance of a particular index, commodity, bonds, or a basket of assets like an index fund. They offer investors a way to gain exposure to a diversified portfolio of assets without having to buy each individual security separately.

- Provident Funds:-A provident fund is a type of retirement savings fund that is typically set up and managed by an employer or government for the benefit of employees. Provident funds are designed to help employees accumulate savings over their working years, which can then be used to fund their retirement or other long-term financial goals.

- Asset Management Companies:-Asset management companies (AMCs) are financial institutions that manage and invest funds on behalf of individuals, institutions, or other entities

Difference Between FII and DII:

FIIs: FIIs are institutional investors from outside the country where they are investing.These can include Foreign Bank,Hedge Funds,Pension Funds etc.

DIIs:DIIs, on other hand, are institutional investors that operate within the countries where they invest.These include mutual funds,insurance companies, banks etc.

Source of Capital:

FIIs: FIIs use funds from investors located outside the country to invest in the financial markets of another country. They bring foreign capital into the local markets.

DIIs: DIIs use funds that originate from within the country where they are investing. These funds come from domestic investors, such as individuals, corporations, and other local entities.

Regulatory Limits:

FIIs: FIIs could only invest up to 24% of the entire paid in capital of the company.

DIIs:DIIs ownership is not subject to such restrictions.

Investment Strategies:

FIIs: FIIs invest with a sort to medium term horizon in mind.

DIIs: DIIs make long term investements.

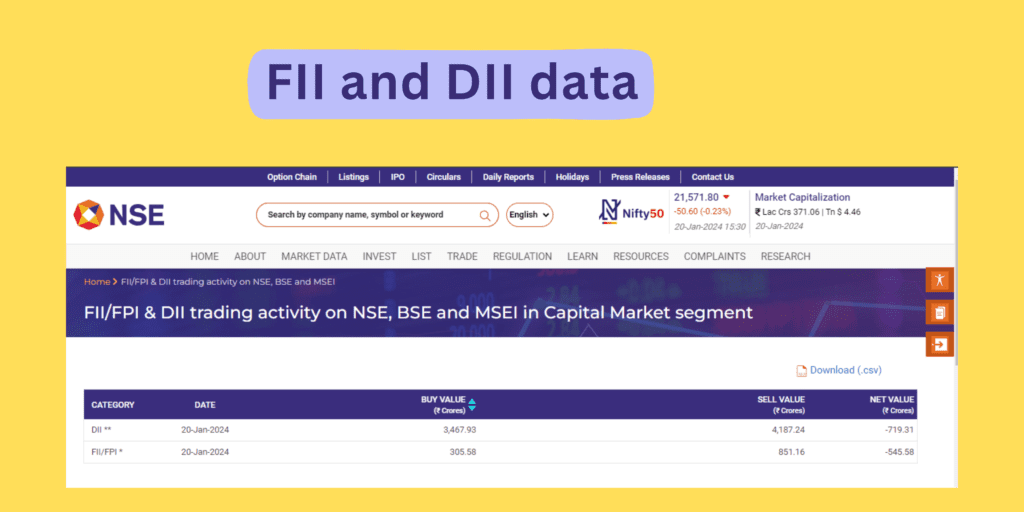

How to watch FII and DII data:

FII and DII show their data everyday when market is open in the evening after 8 pm.

See FII and DII data here:-CLICK HERE

This data shows the amount of money FII and DII buy or sell in stock market.

Benefits of FIIs and DIIs:

- Enhance market depth and liquidity,making it easier for buyer and seller to execute trade.

- Provide volatility to the market.

- Helps in the capital inflow and Economic development.

- It supports the new companies and IPOs by providing capital for new companies entering the market.

- Provide stability in the market by investing for long term.

What a knowledge sir🫡